A climate technology company announced plans to build a direct air capture (DAC) CO2 removal system in Wyoming is creating quite the buzz.

CarbonCapture Inc. formed a partnership with Frontier Carbon Solutions, a partnership the companies dubbed Project Bison. In its press release announcing the project, the companies said this facility will be the largest carbon removal system of its kind. By 2030, the company said it will remove 5 million tons of atmospheric CO2 every year.

That’s roughly the equivalent emissions put out by 762,000 cars per year.

“With the passage of the Inflation Reduction Act, the proliferation of companies seeking high-quality carbon removal credits, and a disruptive low-cost technology, we now have the ingredients needed to scale DAC to megaton levels by the end of this decade,” said CarbonCapture CEO and CTO Adrian Corless, in the release.

The recently passed Inflation Reduction Act, which appropriated millions for various green energy initiatives, boosted the tax credit companies can tap into for direct air capture projects from $50 per ton of CO2 to $180 per ton of CO2.

To put this into perspective, according to figures from NASA, a gallon of gasoline produces 20 pounds of CO2 when burnt in an engine. So, if CO2 emissions were taxed at $180 per ton, every gallon of gas sold would need to be taxed about $1.80 on top of existing taxes.

The 45Q tax credit, as it’s called, is intended to incentivize these kinds of projects as another tool to fight climate change. While the tax credit isn’t a direct subsidy paid to a company, an enormous amount of capital will need to be invested to scale these kinds of technologies up to a level they have any meaningful impact on CO2 emissions.

Bobby Tudor of Houston-based Tudor, Pickering, Holt & Co., a Houston-based investment and financial advising firm with ties to the oil and gas industry, told Bloomberg last June that in order to get a return on commercial-scale projects, it will require a price to be placed on the CO2 that’s captured. That means, Tudor told Bloomberg, “significant government subsidies.”

Ultimately, that would mean carbon taxes that companies will pay for the CO2 emissions they produce in the course of business.

Energy expert Alex Epstein, author of Fossil Future, warns this kind of tax will ultimately increase the cost for all businesses.

“Since all energy directly or indirectly emits CO2, a carbon tax would make all energy more expensive — adding the most costs to coal, oil, and natural gas,” Epstein wrote in an online resource of talking points on energy issues.

The Institute for Energy Research, a nonprofit doing research on government regulation and global energy markets, analyzed Australia’s carbon tax impacts. One year after it was enacted, Australians saw their home electricity prices jump by 15%. By the time the tax was repealed the following year, it accounted for 19% of household energy costs, the study found.

Neither CarbonCapture nor Frontier Carbon Solutions responded to requests for more information on Project Bison, such as where in Wyoming the facility will be located.

Fast Company, a business publication, reported that initial costs for CO2 captured through the Project Bison system will be $600 to $700 per ton, and Corless told the publication they hope to get that figure down to $250 per ton by the end of the decade.

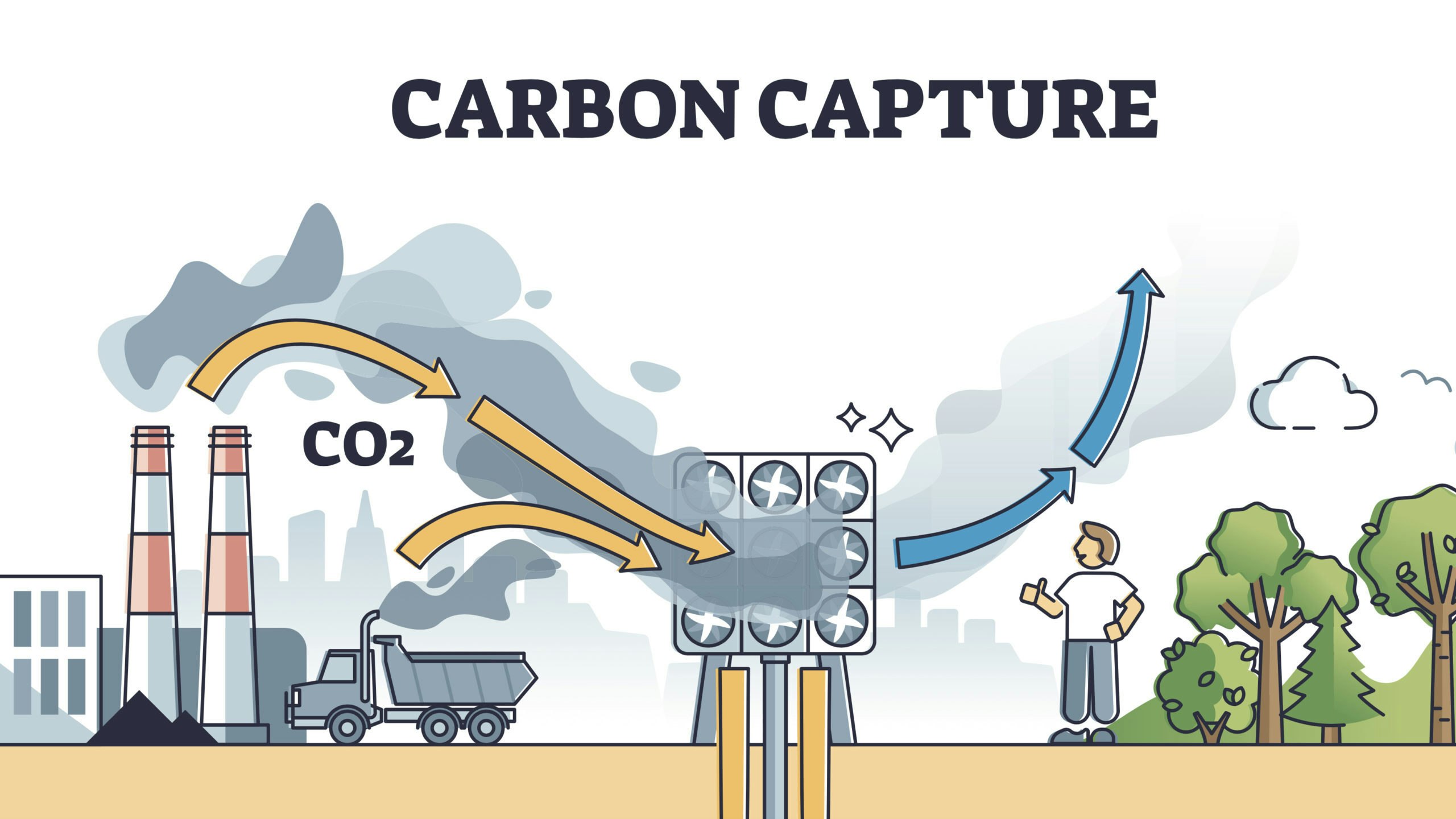

On its website, CarbonCapture explains that the Project Bison air capture machines will “soak up atmospheric CO2 and release concentrated CO2 when heated. The captured CO2 is then permanently stored underground or used to make products that need clean CO2.”