Business & Tourism

News

International Markets Worth Big Money For Wyoming Tourism

Italy's Christian Josso has been working to set up whiskey tours for all the “pure whiskey lovers” of Europe. Josso thought these tours should start in Kentucky or Tennessee, states with long histories in whiskey. But now he's thinking of starting in Wyoming.

Renée JeanApril 22, 2024

Bringing In Billions, Outdoor Recreation Now A Wyoming Revenue Juggernaut

With stunning vistas and outdoor recreation opportunities within driving distance of every community in Wyoming, the Cowboy State is the fourth-fastest growing outdoor economy in the nation, with over $2 billion generated in 2023.

Renée JeanApril 21, 2024

New Life For 110-Year-Old Stringer Hotel, Dubois’ Oldest - And Tallest - Building

When Jason Kintzler learned someone was going to buy the 110-year-old Stringer Hotel in Dubois and tear it down, he bought the building himself to save it. Now it's one of Dubois’ oldest and tallest, and has a new lease on life.

Renée JeanApril 21, 2024

Eating Wyoming: Although A "Blip On The Map," There's Great Food In Hawk Springs

Hawk Springs may just be a blip on the map in eastern Wyoming with a population of 45 but The Emporium is a top-notch steakhouse with prime rib, steaks, burgers and more, as well as Papa’s special buttermilk pie.

Renée JeanApril 21, 2024

Cokeville Solar Project Stalled By Mystery Ownership, Potential Litigation

A solar farm project south of Cokeville in southwestern Wyoming has stalled in Lincoln County with construction plans halted amid murky ownership and cloud of litigation. Ownership of the $175 million solar farm project has been a game of musical chairs.

Pat MaioApril 21, 2024

Tourists Drive Past ‘Road Closed’ Signs On Way To Yellowstone, Get Stuck For 6 Hours

A Cody tow truck driver was mobilized in the wee hours of the morning Thursday to rescue a family trying to get to Yellowstone. Instead, they drove past “road closed” signs and got stuck for six hours.

Ellen FikeApril 19, 2024

Wyoming Office Of Tourism Stops Wildlife Ads In Wake Of Wolf Abuse Scandal

Wyoming’s wildlife is a big tourism draw, but the state Office of Tourism has paused all of its wildlife tourism advertising in the wake of the wolf torture case that has sparked worldwide outrage.

Renée JeanApril 19, 2024

Wyoming Tribes May Be On Path To Get 60,000 Acres Of Federal Land

After about a century of managing about 60,000 acres in northern Fremont County, a federal agency is ready to give it to someone else. Top contenders are the Bureau of Land Management and Wyoming’s Eastern Shoshone and Northern Arapaho tribes.

Clair McFarlandApril 18, 2024

Fireworks Businesses In Southeast Wyoming Denied Permits Because They’re “Obnoxious”

The Laramie County Commissioners on Wednesday denied permits to two fireworks businesses on the Wyoming - Colorado border because their loud marketing — often with a bullhorn and targeting a competitor — is too “obnoxious.”

Ellen FikeApril 18, 2024

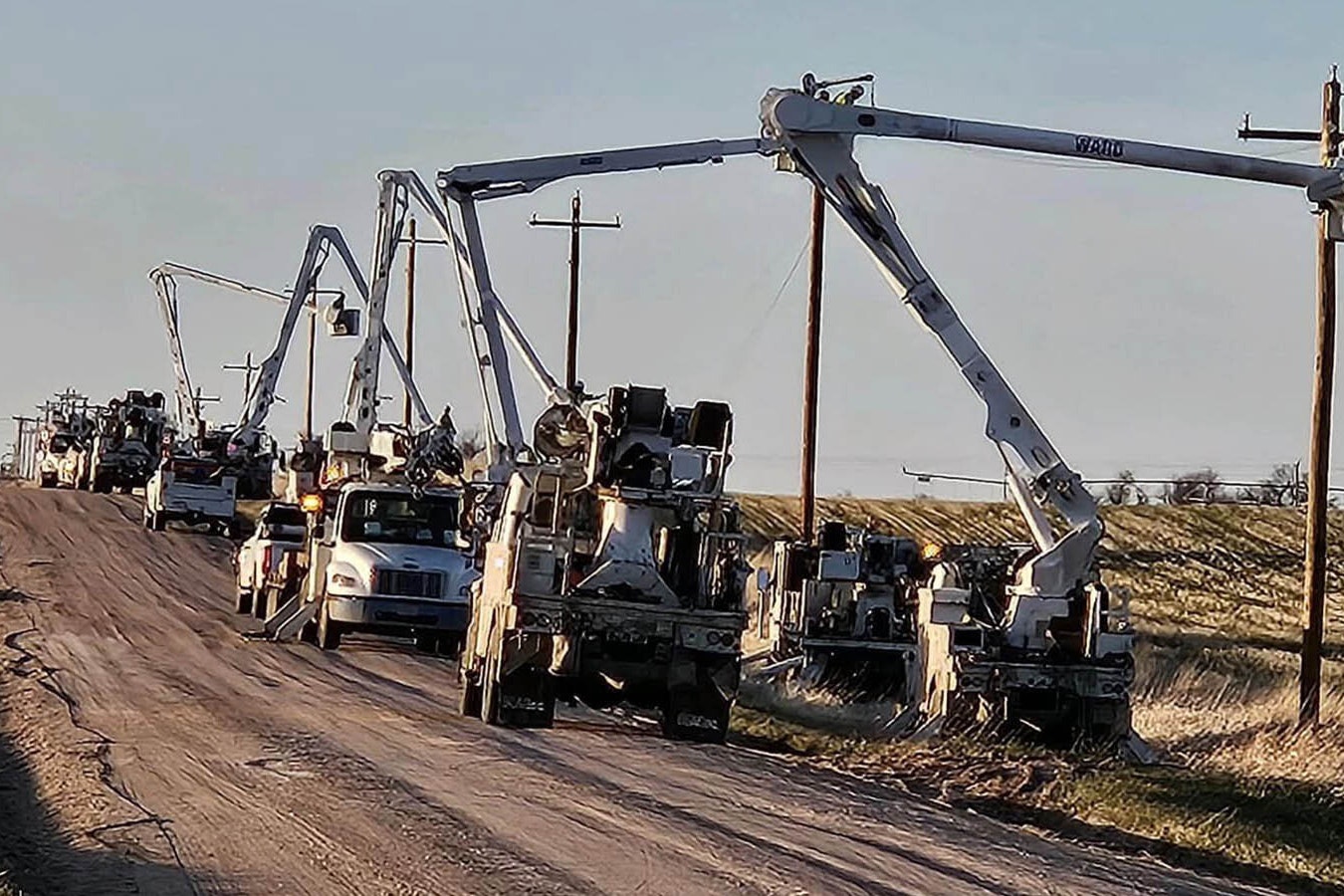

Small Wyoming Power Co-Op Scrambles To Fix 600 Downed Power Poles

High West Energy, a small rural power cooperative based in Pine Bluffs, Wyoming, has been scrambling for 10 days fixing nearly 600 power poles that were downed during a recent wind and snowstorm.

Ellen FikeApril 17, 2024

Casper Post Office Downsized, Leaving Wyoming Without A Major Mail Center

The U.S. Postal Service announced Tuesday it will downsize the Casper Post Office, which comes about a month after doing the same to Cheyenne’s, leaving Wyoming without a major mail processing center.

Renée JeanApril 17, 2024

Old Chicago In Cheyenne Closes Without Warning — Even To Employees

The doors to Old Chicago in Cheyenne suddenly closed Sunday without warning or explanation, employees say. They say they showed up to work, were told not to clock-in, and to go home. Other locations in the state remained open.

Renée JeanApril 15, 2024